irs unemployment tax break refund update

Dont expect a refund for unemployment benefits. Irs Tax Refund in Piscataway NJ.

The 2022 Tax Season Has Started Tips To Help You File An Accurate Return Internal Revenue Service

The Capital IRS Tax Group.

. Homeowners who filed a Homestead Benefit application last year. A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. ANCHOR payments will be paid in the form of a direct deposit or check not as credits to property tax bills.

Federal Tax Refund E-File Status Question. New Jersey State Tax Refund Status Information. The IRS has sent 87 million unemployment compensation refunds so far.

When Will The Irs Send Refunds For The Unemployment Compensation Tax Break. The IRS previously issued refunds related to unemployment compensation exclusion in May and June and it will continue to issue refunds throughout the summer. The federal tax code counts jobless.

Name A - Z Sponsored Links. Taxpayers who have access to a Touch-tone phone may dial 1-800-323-4400 within New Jersey New York Pennsylvania Delaware and. A quick update on irs unemployment tax refunds today.

By Anuradha Garg. Once those corrections are finished the IRS said it will adjust returns for those who are married and filed jointly and are eligible for the 20400 exclusion. Log In Sign Up.

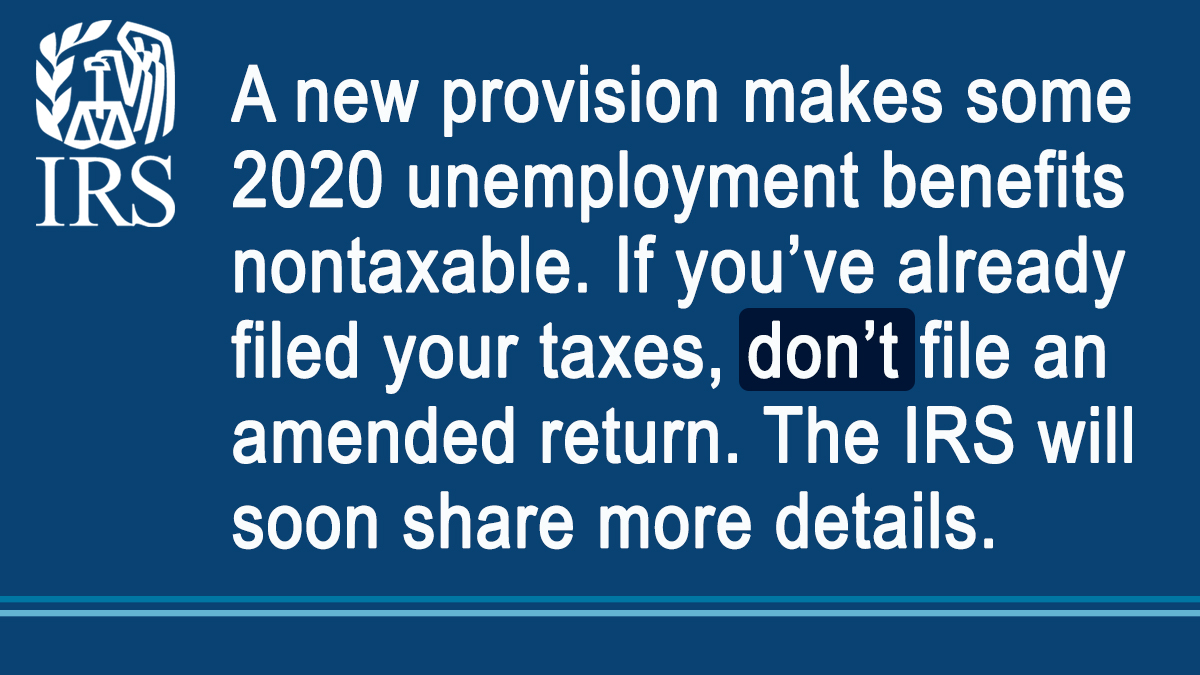

The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of. The american rescue plan act which was signed on march 11 included a 10200 tax exemption for 2020 unemployment. After more than three months since the IRS last sent adjustments on 2020 tax returns the agency.

The IRS announced earlier this month that the agency had begun the process of adjusting tax. The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189. 22 2022 Published 742 am.

Unemployment tax break update. And this tax break only applies to 2020. IRS to begin issuing refunds this week on 10200 unemployment benefits Millions of Americans are due money if they received unemployment benefits last year and.

If both spouses lost work in 2020 a married. If you received unemployment benefits in 2020 a tax refund may be on its way to you. IRS to begin issuing refunds this week on 10200 unemployment benefits Millions of Americans are due money if they received unemployment benefits last year and.

Only up to the first 10200 of unemployment compensation is not taxable for an individual. The IRS has sent 87 million unemployment compensation refunds so far.

How To Claim Unemployment Tax Exemption In 2021 Nextadvisor With Time

Unemployment 10 200 Tax Break Some States Require Amended Returns

The Irs Can Seize Your Unemployment Tax Refund For These Reasons

Irs Sending Out More 10 200 Unemployment Tax Refund Checks Here S How To Track Your Payment The Us Sun

Irs Starting Refunds To Those Who Paid Taxes On Unemployment Benefits

Irs Unemployment Tax Refund Update Direct Deposits Coming

If You Got Unemployment Benefits In 2020 Here S How Much Could Be Tax Exempt Abc News

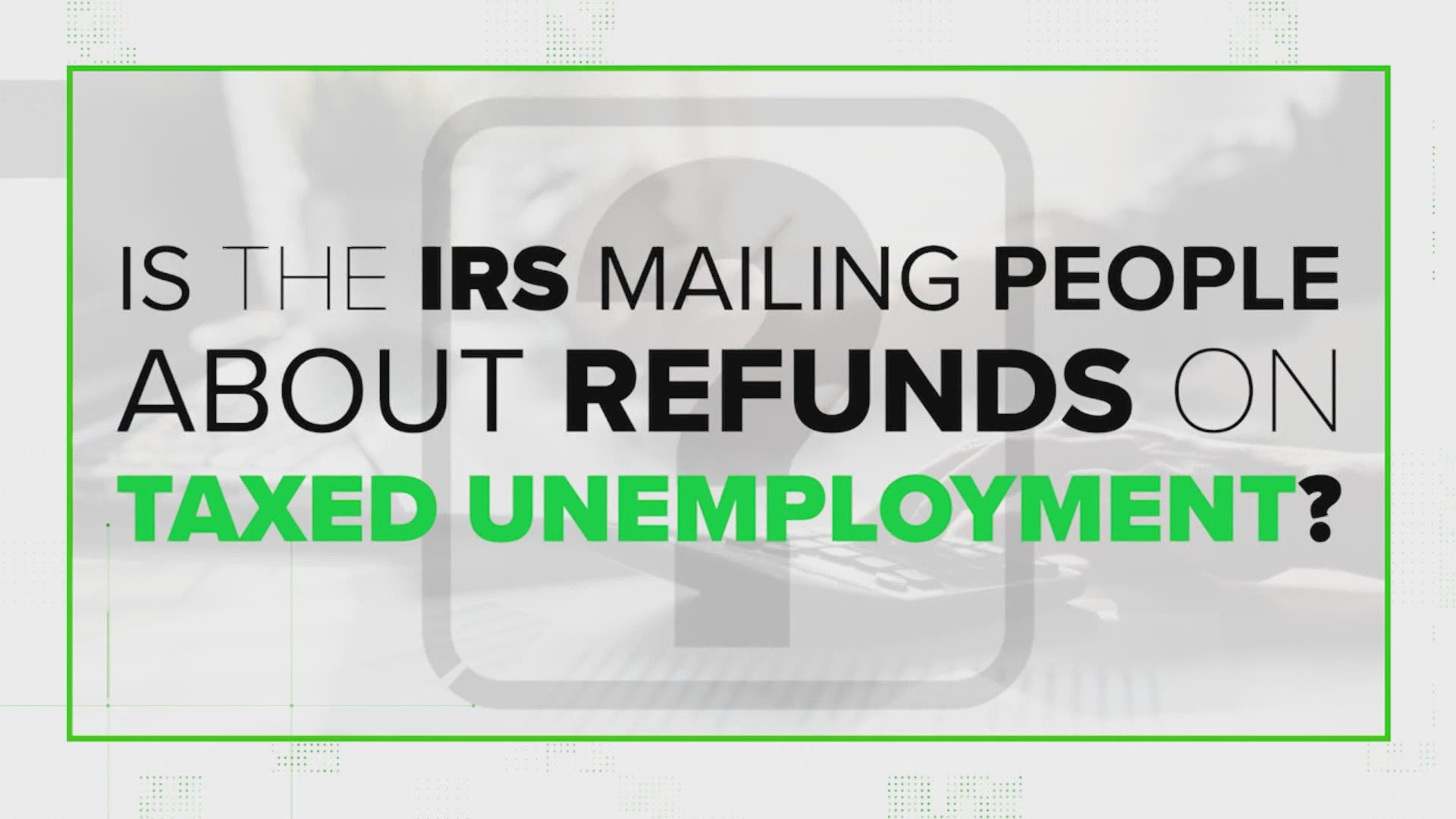

Irs Is Mailing Refunds To Some Taxpayers Who Claimed Unemployment Wfaa Com

Irs Still Sending Unemployment Tax Refunds

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

Irs Announces It Will Automatically Correct Tax Returns For Unemployment Tax Breaks

Irsnews On Twitter If You Received Unemployment Benefits Last Year And Already Filed Your 2020 Tax Return Don T File An Amended Return Irs Will Be Issuing Guidance To Address Changes Brought By

Amended Tax Return May Be Needed For Some Unemployed Workers Irs Says

Unemployment Benefits Tax Refund Will You Receive One Waters Hardy And Co P C

Your Unemployment Tax Refund Is Coming In May Irs Says Here S How To Get Yours Nj Com

Irs Refunds For Unemployment Tax Break To Be Issued In May

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Tax Refunds On 10 200 Of Unemployment Benefits Begin This Month In May Who Ll Get Them First Local3news Com

Update Irs Says No Amended Returns Needed For Federal Unemployment Tax Break